Getting a TIN ID is an easy process if you know the procedure for how to get TIN ID Online. Here you will find the complete guide on how to get TIN ID online and from RDO office to register as a taxpayer with Bureau of Internal Revenue, Department of Finance, Philippines.

There are two forms of TIN ID called Physical TIN ID Card and Digital TIN ID Card. The physical and Digital TIN ID cards appear different but they are equally valid in whole Philippines.

Here I am going to explain a guide on how to get Physical TIN ID as well as Digital TIN ID in easy words.

What is TIN ID?

The TIN stands for Taxpayer Identification Number which is a unique number issued by the Bureau of Internal Revenue (BIR) via Online Registration and Update System (ORUS) and Revenue District Office (RDO). The BIR provides TIN ID for individuals and TIN ID for non-individuals i.e. companies or business organizations.

The primary use of TIN ID or TIN Number is for tax purposes. But now many government agencies and private financial institutes consider TIN ID Card as a valid identity proof document.

What Details Your TIN ID Contain

Your TIN ID contains Your Name, Date of Birth, Address, TIN Number, TIN Issue Date, Your Photo and Signature. The New Physical TIN ID and Digital TIN ID also contain a Unique QR Code that can be scanned by government agencies and other institutes for TIN ID validation and verification purposes.

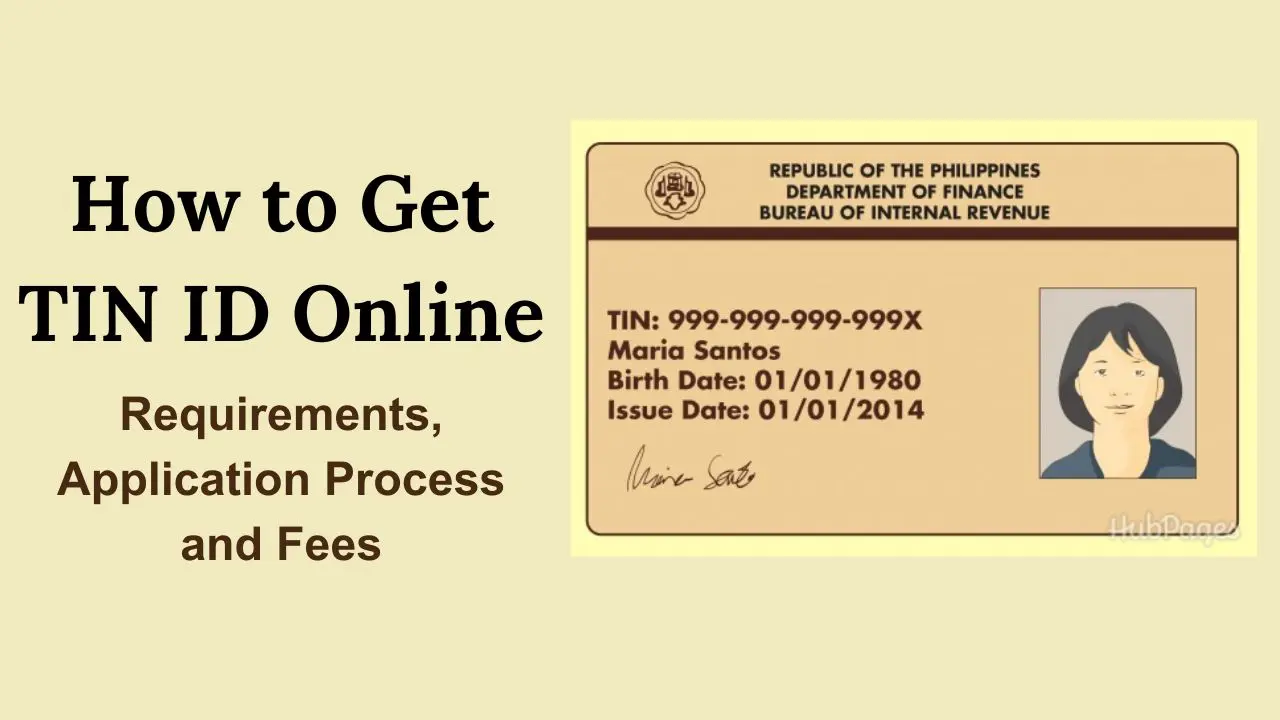

TIN ID Card Sample

The Conventional TIN ID Card has yellowish shade, while the New TIN ID Card comes with greenish appearance. Both the old and new TIN ID Cards come in horizontal format. Here I provide a sample of both the conventional and new TIN ID cards for you.

How to Apply for TIN ID Offline In-person

You cannot go to any random RDO Office to apply for a TIN ID in-person, you have to visit the RDO Office that is assigned to your city/town jurisdiction by the Bureau of Internal Revenue, Republic of the Philippines.

In order to know about your concerned RDO Office, you can contact Bureau of Internal Revenue (BIR) Helpline Number or BIR Email Address given below.

- BIR Helpline Number – 8538-3200,

- BIR Helpline Email: contact_us@bir.gov.ph

Here I provide a step-by-step guide to apply for TIN ID in-person at an RDO office as follows;

- Call up BIR Helpline Number 8538-3200 to know your city/jurisdiction RDO office.

- Go to BIR web portal Contact Us page.

- Click on Regional/District Offices under Directory.

- Check the list to find your city/region and click on + button.

- Scroll down to find your concerned Regional District Office (RDO) and note down its address.

- Go to your concerned RDO Office and meet the service executive.

- Ask for a BIR Application Form as applicable.

- Fill up the BIR Form with requested details and attach required documents & photograph.

- Submit your BIR Form for TIN ID to relevant service executive and pay the fee.

- The RDO office may issue your TIN ID on the same day or in 1-3 working days. You need to visit the same RDO office again to collect your TIN ID Card.

- Sign the TIN ID Card and paste your 1 x 1 photograph in the picture box.

In this way, you can register yourself as a taxpayer and apply for a TIN ID Card at the RDO office.

What is Digital TIN ID?

The Digital TIN ID is a new form of the TIN ID Card and it is available for all individuals and business companies in Philippines.

On November 21, 2023, the Bureau of Internal Revenue, Department of Finance started Digital TIN ID Online Service through BIR ORUS (Online Registration and Update System).

On November 29, 2023, the Bureau of Internal Revenue published a circular to inform that the Digital TIN ID is an alternative of Physical TIN ID Card and the taxpayers can now obtain a Digital TIN ID online without going to the BIR Revenue District Office and standing in long queues.

Is Digital TIN ID Valid?

The Digital TIN ID is a valid TIN Card same as the Physical TIN ID Card across entire Philippines country. All government offices/agencies and private institutions accept the Digital TIN ID as a valid identification document as per rules.

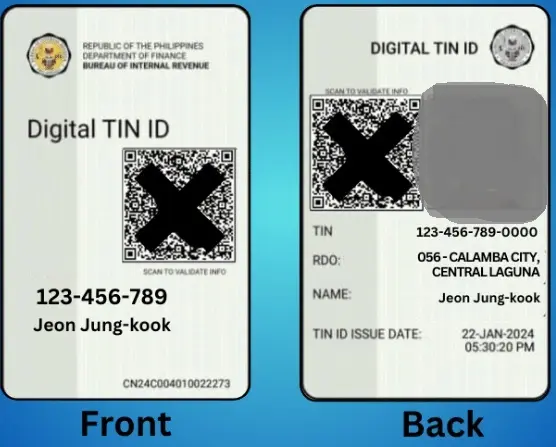

Digital TIN ID Sample

The Digital TIN ID Card comes in vertical format and it also contains a QR Code so that the government and private agencies can scan the QR Code to validate the TIN ID. Here I provide a sample of BIR Digital TIN ID Card as under;

How to Get Digital TIN ID Online

In order to get your TIN ID online for the first time, you have to register yourself or your business on BIR ORUS web portal. After registration, you need to login and submit an online application for TIN ID with required fees and documents.

If you registered earlier, you do not need to register again. You can login to BIR ORUS web portal to update your information and apply for a TIN ID online. Here I provide the steps for digital TIN ID online as follows;

Part 1: Taxpayer Registration at BIR ORUS Portal

- Go to BIR ORUS web portal @orus.bir.gov.ph.

- Click on New Registration section.

- Select Individual or Non-Individual as applicable.

- Read the requirements and click on Create An Account.

- Accept Terms & Conditions, select Register As Taxpayer.

- If you have a TIN, select With Existing TIN otherwise select Without Existing TIN.

- Choose your User Type (Filipino Citizen or Filipino Overseas Worker or any other) and provide necessary information.

- Complete your account profile and save it to finish the registration process.

Part 2: Login & Apply for TIN ID Online at BIR ORUS Portal

After completing the registration process, you are ready to login to ORUS BIR web portal and apply for TIN ID online.

- Go to BIR ORUS web portal @orus.bir.gov.ph.

- Click on LOGIN button given on upper right corner.

- Enter your Email and Password, then tick the Captcha box and click on Login.

- Find and select View Your Digital TIN ID option.

- Read the instructions carefully and click on View Your Digital TIN ID.

- Check your personal details shown on the draft of your Digital TIN ID.

- Upload your recent photograph in 1 x 1 size with white background without borders.

- Click on Confirm to accept terms & condition and to generate your Digital TIN ID.

- Return to ORUS Home, click on Get Your Digital TIN ID from left-side menu.

- Read the instructions and click on Get Your Digital TIN ID at the bottom.

- Your Digital TIN ID will appear on screen, you can view its front, back and click on Download to get it on your device.

In this way, you can register as a taxpayer and apply online for your TIN ID through ORUS BIR website portal.

TIN ID Requirements

The Bureau of Internal Revenue requests a completed BIR form and some specific documents with TIN ID Application. If you want to apply for a TIN ID in Philippines, make sure that you know about TIN ID requirements as stated by BIR, Department of Finance.

The required documents are different for different categories of applicants, here I provide all the documents and requirements for TIN ID as follows;

For Self-employed and Mixed Income Individuals:

Mandatory Documents

- BIR Form No. 1901;

- Any government-issued ID (e.g. PhilID/ePhilID, Passport, Driver’s License/eDriver’s License,) that shows the name, address, and birthdate of the applicant, in case the ID has no address, any proof of residence or business address;

- In case of the practice of profession regulated by PRC: A valid PRC ID and government ID showing address or proof of residence or business address (one photocopy).

- BIR Printed Invoices or Final & clear sample of Principal Invoices;

Other Documents, Only If Applicable

- If transacting through a Representative:

- Special Power of Attorney (SPA) executed by the taxpayer-applicant indicating specific transaction; [1 original for first time submission, if authorized to more than one transaction, submit certified true copy (together with the original copy for presentation and validation only)].

- Any government-issued ID of the taxpayer and authorized representative. (1 photocopy, both with one specimen signature)

- DTI Certificate (if with business name);

- Work Visa (9g) for Foreign Nationals;

- Service Contract showing the amount of income payment, for Job Order or Service Contract Agreement with NGAs, LGUs, GOCCs, GFIs;

- Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier);

- Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity;

- Proof of Registration/Permit to Operate BOI/BOI-ARMM, PEZA, BCDA, TIEZA/TEZA, SBMA, etc;

For Individuals Earning Purely Compensation Income:

For Local Employee

- BIR Form No. 1902;

- Any government-issued ID (e.g. Phil ID/ePhil ID, Passport, Driver’s License/eDriver’s License,) that shows the name, address, and birth-date of the applicant, in case the ID has no address, any proof of residence or business address.

For Foreign National Employee (Expat Resident)

- BIR Form No. 1902;

- Passport (Bio page, including date of entry/arrival and exit/departure stamp, if applicable.

- For International Gaming Licensee (IGL) or POGO Employees Only – Employment contract or equivalent document indicating the duration of employment, compensation and other benefits, and scope of duties (1 certified true copy).

For Business Corporations, Partnerships, Cooperatives and Associations (Taxable and Non-taxable):

- BIR Form No. 1903;

- SEC Certificate of Incorporation; OR Certificate of Recording (in case of partnership); (1 photocopy) OR License to Do Business in the Philippines (in case of foreign corporation); OR Cooperative Development Authority (CDA) Certificate of Registration; OR Certificate of Registration issued by Housing and Land Use Regulatory Board (HLURB); OR Certificate of Registration issued by Department of Labor and Employment (DOLE).

- Articles of Incorporation; OR Articles of Partnerships; OR Articles of Cooperation; OR Articles of Association; OR Constitution and by-laws of the applicant union; [for Labor Organization, Assoc. OR Group of Union or Workers].

- BIR Printed Invoices or Final & clear sample of Principal Invoices;

For Estate and Trust:

- BIR Form No. 1901;

- For Estate with properties subject to Estate taxes or Estate under judicial settlement: Death Certificate of the decedent; (1 photocopy)

Note: Request for the cancellation of decedent’s TIN by the heir or administrator or executor.

- For Trust (irrevocable): Irrevocable Trust Agreement (one photocopy).

For Non-resident Foreign Corporations:

- Tax Form through Online Application Only (ORUS)

- Any Apostilled official documentation issued by an authorized government body (e.g. government agency (tax authority) thereof, or a municipality) that includes the name of the non-individual and the address of its principal office in the jurisdiction in which the non-individual was incorporated or organized (e.g. Articles of Incorporation, Certificate of Tax Residency); (1 certified true copy).

For One Time Transaction Taxpayers Who Don’t Have TIN ID:

- BIR Form No. 1904;

- Any government-issued ID (e.g. Phil ID/ePhil ID, Passport, Driver’s License/eDriver’s License,) that shows the name, address, and birth-date of the applicant, in case the ID has no address, any proof of residence or business address.

- Marriage Contract is required for married women.

For transfer of properties by succession

- Death Certificate of decedent or Extrajudicial Settlement of the Estate/Affidavit of Self Adjudication.

For Persons Registering under E.O. 98:

In order to do transactions with government offices such as NBI, DFA, LTS and others, you must register with BIR under E.O. 98 with following form and documents.

- BIR Form No. 1904;

- Any government-issued ID (e.g. Phil ID/ePhil ID, Passport, Driver’s License/eDriver’s License,) that shows the name, address, and birth-date of the applicant, in case the ID has no address, any proof of residence or business address.

- Marriage Contract is required for married women.

TIN ID Fees

The Bureau of Internal Revenue provides the New TIN ID Card for free to the first time taxpayer applicants. In case you lost your TIN ID and want a replacement TIN ID, you need to pay P 100 as fee.

The Bureau of Internal Revenue (BIR) was charging the annual registration fee of P 500 from taxpayers. However, the BIR authority has eliminated the registration fee on January 22, 2024. Therefore the taxpayers do not need to pay any registration fee to BIR.

Can Unemployed People and Students Get TIN ID?

Yes, the Bureau of Internal Revenue allows the unemployed Filipino citizens and students to get a TIN ID with BIR Form 1904. If you want to apply for a TIN ID/Number for Unemployed or Students, just go through the online application process given below;

- Go to ORUS BIR portal @orus.bir.gov.ph.

- Click on New Registration and select As An Individual.

- On the right side, click on Create An Account option.

- Read the Terms of Service, tick the box and click on Agree button.

- Select Taxpayer, Without Existing TIN and click on I Agree.

- Select User Type as Get TIN for Filipino Citizen E.O. 98/ One Time Tax Payer.

- Select Executive Order No.98 Filipino Citizen.

- Enter your personal details, Create password and click on Register.

- Login with your Email and Password.

- Select Get Your Digital TIN ID and follow on-screen instructions.

- Upload your photo in 1 x 1 size and generate your TIN ID online.

- View and Download Your Digital TIN ID Card.

In this way, you can get a TIN ID for unemployed Filipino Citizens and Students.

What to Do If I Lost My TIN ID Card?

In case you have lost your TIN ID Card, you must apply for a replacement TIN ID to your concerned RDO office. You have to make an Affidavit stating that your TIN ID is lost and submit the Affidavit at the RDO office when you apply for the replacement TIN ID.

If your TIN ID Card is damaged, you must submit the Original Damaged TIN ID Card to the RDO office when you apply for the replacement TIN ID.

- Go to your concerned city/region RDO office.

- Request for a Replacement TIN ID Card.

- Provide the Affidavit and other supporting documents.

- Provide your recent photo and pay P 100 as replacement fee.

- Submit your application and ask the executive about processing time.

- The RDO office executive may issue your Replacement TIN ID Card instantly or request you to collect it the next day.

- Once the TIN ID Card is ready, you can collect it from the RDO office.

So, this is how you can get a replacement TIN ID in case you have lost it or your TIN ID Card is damaged.

TIN ID Validity

The TIN ID Card does not come with any validity or expiry date. It means that your TIN ID is valid for lifetime. Therefore you do not need to worry about its validity, expiry, renewal or anything else.

Conclusion

The Taxpayer Identification Number (TIN) is important for everyone living in Philippines, therefore I have explained the process for how to get TIN ID above to make it easy for you.

In case you want to know more about TIN ID requirements and its importance, you can call up BIR Helpline Number 8538-3200 or ask your doubts in the comment section given below.

In case you still have a query or doubt, you can ask it in the comment section to get a response from our team in next 24 to 48 hours.

FAQs

How do I get TIN ID for first time?

You can get TIN ID for first time from the RDO Office of your city/region or you can get TIN ID online through BIR web portal.

Which RDO office can I go to get my TIN ID?

You can go to the RDO office that is assigned to your city/jurisdiction to get your TIN ID. For example: If you live in the east region of Makati City, your concerned RDO office is the Revenue District Office No.47.

Do I need to login to get TIN ID online?

Yes, you have to login to ORUS BIR web portal to get TIN ID online, generate your Digital TIN ID Card and download it.

How much TIN ID Card Fee?

The TIN ID Card Fee is Zero, the Bureau of Internal Revenue does not charge any fee for the New TIN ID Card from fresh applicants.

How much is TIN ID Replacement Fee?

In case of lost or damage, you have to apply for a replacement TIN ID and pay TIN ID Replacement Fee of P 100.

How long is my TIN ID validity?

Your TIN ID validity is lifetime, it means that your TIN ID will never expire and never need renewal.

Can I have two TIN IDs?

As per Government Rules, one person can have only one TIN ID at a time. Having multiple TIN IDs is a illegal and is punishable with the fine of P 1000 for every additional TIN.

1 thought on “How to Get TIN ID Online -Requirements, Application Process and Fees”